The following points highlight the three distinct periods of

paper currency in the history of British India. The periods are:

1. Paper Currency Prior to 1861

2. Paper Currency between 1861 to 1919

3. Paper Currency after 1919

1. Paper Currency Prior to 1861:

Prior to 1861, the right of note-issue belonged to private banks, there being no government issue of currency notes. The Bank of Hindustan, founded as early as 1770, obtained a note circulation “which occasionally reached Rs. 40-50 lakhs and averaged half that amount.”

The Commercial Bank, which began business in 1819, had an average circulation of Rs. 16 lakhs while the Calcutta Bank had of Rs. 20 lakhs.

The most important of these note-issuing banks were the three Presidency Banks. Through earlier, the Bank of Bengal had been given the power to issue notes up to four times its capital, the charter of 1839 fixed the note circulation at Rs. 2 crores.

The Bank of Bombay also had, by an Act passed in 1840, its note circulation limited to Rs. 2 crores.

In 1843, the Bank of Madras was allowed to issue notes up to a maximum of Rs. 1 crore. Thus, prior to the introduction of a government paper currency, the combined authorised issue of three Presidency Banks was rupees five crores against which ¼ was to be held in specie.

According to Keynes, the circulation of the notes of these banks, hedged about as it was with so many restrictions, “never became important” and was mostly confined to the cities of Calcutta, Madras, and Bombay. What is more, these notes were not legal tender.

2. Paper Currency between 1861-1919:

By about the 40’s of the 19th century, opinion began to grow that the responsibility of a sound paper currency system should be entrusted to the government only. By this time, the official mind had also been made up and, in April 1859, the Government of India forwarded its proposals for a government paper currency.

The scheme, as submitted, was turned down although the Secretary of State promised every encouragement to a well-considered scheme. A new scheme was submitted in 1860 but Mr. Wilson, its author and Finance Member, died before it could be put into operation. A modified version was finally incorporated in the Act XIX of 1861, effective from 1 March, 1862.

1. The Act provided for the establishment of a Government monopoly of note-issue, and creation of a paper currency department through which government were to issue notes of various denominations in the form of promissory notes payable to bearer on demand. Initially, the Presidency Banks were made “agents for the issue, payment, and exchange of promissory notes of the Government of India and carrying on the business of an agency of issue.”

Subsequently, on objection from the Secretary of State, these banks were dissociated from currency business with effect from January, 1866.

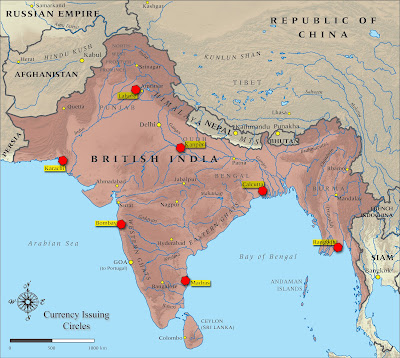

2. The Act divided India into three circles, raised to 7 in 1910, of issue with headquarters at Calcutta, Bombay, Madras, Kanpur, Karachi, Lahore and Rangoon. Every note was a legal tender only within its own circle but not outside it. Payment of dues to the government, however, could be made in the currency notes of any circle.

1. Paper Currency Prior to 1861

2. Paper Currency between 1861 to 1919

3. Paper Currency after 1919

1. Paper Currency Prior to 1861:

Prior to 1861, the right of note-issue belonged to private banks, there being no government issue of currency notes. The Bank of Hindustan, founded as early as 1770, obtained a note circulation “which occasionally reached Rs. 40-50 lakhs and averaged half that amount.”

The Commercial Bank, which began business in 1819, had an average circulation of Rs. 16 lakhs while the Calcutta Bank had of Rs. 20 lakhs.

The most important of these note-issuing banks were the three Presidency Banks. Through earlier, the Bank of Bengal had been given the power to issue notes up to four times its capital, the charter of 1839 fixed the note circulation at Rs. 2 crores.

The Bank of Bombay also had, by an Act passed in 1840, its note circulation limited to Rs. 2 crores.

In 1843, the Bank of Madras was allowed to issue notes up to a maximum of Rs. 1 crore. Thus, prior to the introduction of a government paper currency, the combined authorised issue of three Presidency Banks was rupees five crores against which ¼ was to be held in specie.

According to Keynes, the circulation of the notes of these banks, hedged about as it was with so many restrictions, “never became important” and was mostly confined to the cities of Calcutta, Madras, and Bombay. What is more, these notes were not legal tender.

2. Paper Currency between 1861-1919:

By about the 40’s of the 19th century, opinion began to grow that the responsibility of a sound paper currency system should be entrusted to the government only. By this time, the official mind had also been made up and, in April 1859, the Government of India forwarded its proposals for a government paper currency.

The scheme, as submitted, was turned down although the Secretary of State promised every encouragement to a well-considered scheme. A new scheme was submitted in 1860 but Mr. Wilson, its author and Finance Member, died before it could be put into operation. A modified version was finally incorporated in the Act XIX of 1861, effective from 1 March, 1862.

1. The Act provided for the establishment of a Government monopoly of note-issue, and creation of a paper currency department through which government were to issue notes of various denominations in the form of promissory notes payable to bearer on demand. Initially, the Presidency Banks were made “agents for the issue, payment, and exchange of promissory notes of the Government of India and carrying on the business of an agency of issue.”

Subsequently, on objection from the Secretary of State, these banks were dissociated from currency business with effect from January, 1866.

2. The Act divided India into three circles, raised to 7 in 1910, of issue with headquarters at Calcutta, Bombay, Madras, Kanpur, Karachi, Lahore and Rangoon. Every note was a legal tender only within its own circle but not outside it. Payment of dues to the government, however, could be made in the currency notes of any circle.

Calcutta Circle Banknote

Bombay Circle Banknote

Madras Circle Banknote

Cawnpore (Kanpur) Circle Banknote

Karachi Circle Banknote

Lahore Circle Banknote

Rangoon Circle Banknote

3. The Act based the system of note-issue on what is called the “currency principle.” It placed a limit of Rs. 4 crores raised in stages to Rs. 14 crores on the fiduciary issue and all notes issued in excess of this limit had to be covered by an equivalent in silver coin or bullion and, from 1893, in gold coin or bullion or in rupees or silver bullion.

The object of this provision was to prevent over-issue of notes which was regarded as a serious evil because it caused inflation. The only way to prevent this evil was to make the notes convertible into metal and to insist on providing ideal safety. The provision, therefore, had the effect of reducing the notes to “Bullion-Certificates.”

The system of Government note-issue thus evolved was not without defects. In the first place, limitation of the areas of legal tender restricted the popularity of notes and the expansion of currency.

In the second place, the government gained nothing by the issue of notes because the currency officers had to keep in reserve an equivalent amount in coin or bullion. The notes were, therefore, not more economical than rupees.

In the third place, the system lacked one of the essential requirements of a good currency system, namely, elasticity. In the fourth place, the paper currency reserve was open to criticism for its unduly large metallic content and for the investment of a part of it in sterling securities in England. The sterling securities were liable to depreciation in the event of a crisis in England.

The closing of mints to the free coinage of silver in 1893 indirectly led to some relaxation of the rigidity of Indian paper currency system. Further, elasticity was imparted when the rupee became a token coin in 1898.

Up to 1893, the whole of the paper currency reserve was held in India. However, Act IX of 1902 and Act III of 1905 gave full powers to the government to hold the metallic portion of the Reserve or any part of it, either in London, or in India.

The only justification for transferring a part of the reserve to London was to provide means for purchasing silver to be minted into rupees. But experience soon showed that the reserve could, in times of depression, be used to strengthen the exchange-rate. The Govt. therefore, deliberately followed the policy of increasing the gold portion of the paper currency reserve which alone could serve this purpose in time of need.

Another significant development was the policy of the Government to universalize notes of small denominations with a view to enhancing their popularity. The Act VI of 1903 made five rupee notes universal throughout India except Burma where it became so in 1909.

The privilege of an All India note was extended to ten and fifty rupee notes in 1911. The five hundred and thousand rupee notes became universal from 13 June, 1931.

The First World War:

The inelastic nature of the paper currency in India was brought out, as never before, during the war. Before the War, the fiduciary note issue was limited to Rs. 14 crores. Between November 1915 and December 1919, the limit had to be raised a number of times until it was Rs. 120 crores.

With a view to economizing silver, whose rising value made it increasingly difficult for Govt. to coin rupees, currency notes of the value of rupees two and a half and one rupee were issued in 1917.

With a view to reforming paper currency in the light of the experience gained and imparting it greater elasticity, the Babington-Smith Committee recommended.

(a) That the metallic portion of the reserve should be 40% of the gross circulation;

(b) That the limit of fiduciary issue should be retained at Rs. 120 crores;

(c) That as an experimental measure, notes might be issued against the security of bills of exchange up to a limit of Rs. 5 crores;

(cl) That the silver and gold in the paper currency reserve should be held in India except for transitory purposes.

3. Paper Currency after 1919:

In the light of these recommendations, was passed, in October 1920, the Indian Paper Currency (Amendment) Act which made both permanent and temporary provisions, with regard to the paper currency reserve. The temporary provisions, effective from 1 October, 1920, allowed rupee and sterling securities to be held in any proportion up to a total limit of Rs. 85 crores (instead of 120 crores).

Further, the gold and sterling securities in the reserve were to be revalued on the basis of Rs. 10 per Sovereign and the gap was to be filled by the issue of adhoc securities of the Govt. of India. The permanent provisions were so framed as to introduce automatic elasticity in the paper currency circulation in the following two ways:

(a) The fiduciary portion of the reserve was no longer to be a fixed amount but was to be such as not to exceeded the value of the metallic portion;

(b) The controller of currency was authorised to issue, in emergency, notes up to an amount of rupees 5 crores raised to Rs. 12 crores in 1928 against commercial bills of exchange of a maturity not longer than 90 days.

These changes implied a radical departure from the principles of the pre-war Indian paper currency. If the pre-war system was too inelastic and rigid, the pendulum now swung in the opposite direction. Now elasticity was sought to such an extent as to jeopardize the safety of the system. As Chablani laments, “No case was made out for going much further than what the Chamberlain commission recommended.”

Nor was any heed paid to the contention of Mr. Dalail who held that even 80% would not be too high a limit to fix for the proportion of metallic reserve to the total of notes outstanding. None denied the need for elasticity but the crucial point was the extent to which elasticity could be persued consistently with safety.

The experience of the working of this system for the first two years showed the inadequacy of the provision for seasonal expansion of currency. The act was amended in 1923 when the maximum limit of seasonal issue was raised from Rs. 5 crores to Rs. 12 crores.

By a further amending Act passed in 1925, the permissible limit of the holding of securities in the Reserve was raised from Rs. 85 crores to Rs. 100 crores of which not more than Rs. 50 crores could be adhoc securities of the Govt. of India. An interesting feature of the period, 1920 — 25, was the marked decline in the encashment of foreign circle notes.

In 1926, the Indian paper currency system once again came under the searching examination of the Hilton young commission. Its far reaching recommendations were incorporated in the Indian currency Act, 1927, and the Reserve Bank of India Act, 1934.

The Currency Act of 1927 removed the legal tender quality of British Sovereigns and half Sovereigns; fixed the gold value of rupees and notes at the rate of 8.47512 grains troy instead of 11.30016 grains troy for a rupee; bound the govt. to buy gold at a price of Rs. 21.23 per tola of fine gold in the form of bars containing not less than 40 tolas and sell gold or sterling at the same price but in quantities of not less than 400 ozs; declared silver rupee, the silver half-rupee and currency notes as unlimited legal tender but open to issue at the will of the govt.

The recommendations of the Commission regarding the establishment of a central Bank of note-issue and the introduction of proportional Reserve System were realised in the Reserve Bank Act, 1934.

The Act called upon the Reserve Bank to maintain not less than 2/5 of its assets in the Issue Department in gold coin, gold bullion or Sterling Securities provided that the amount of gold was not less than Rs. 40 crores in value, gold being priced at Rs. 21.23 per tola.

The remaining 3/5 of the assets were to be held in rupee coin, Govt. of India securities and specified bills of exchange provided that the rupee securities did not exceed – of the total amount of the assets or Rs. 50 crores whichever was greater.

The period between the wars, with few exceptions, was marked by the return of silver rupees from hoards on the one hand and the replacement of coins by notes on the other. This was made possible by the increasing popularity of notes, the spread of banking facilities, and the free acceptance of bearer cheques.

Paper Currency during the Second World War:

The initial effects of the war on Indian economy, despite the inevitable dislocation it caused in many spheres, wee, on the whole, favourable. Production, prices, and foreign trade received stimulus and the prospects of the agriculturist generally improved.

The Indian currency system withstood the strain extremely well. Confidence in the paper currency was generally maintained despite the increased demand in certain centres for conversion of notes into coins.

Soon, certain very disturbing trends appeared. The enormous expansion of currency overshadowed all others by its spectacular character, wide sweep, and direct impact on the daily life of the common man. The notes in circulation increased from Rs. 179 crores in August, 1939 to Rs. 1152 crores in June, 1945.

Besides, there was also a large increase in the absorption of rupee coins as small coins. The overall increase in all the media of payments, up to the end of March, 1945, totaled up to nearly Rs. 1565 crores. This enormous increase in currency circulation was accompanied by a marked rise in the general price level, the economic advisor’s index rising from 100 in August, 1939 to 247.8 in March, 1945.

Another development, which held far-reaching possibilities for the future, was the large accumulation of sterling securities in the assets of the Reserve Bank. These securities were acquired as a result of war expenditure incurred by the Govt. of India on behalf of the British Govt.

For this, the British Govt. paid sterling securities in England against which the Indian govt. issued rupees in India. Thus, while sterling securities piled up in England, currency expanded in India. It is obvious that the Reserve Bank Act was observed in form than in spirit.